jefferson parish property tax 2020

JEFFERSON LA The Jefferson Parish Adjudicated real estate auction scheduled for August. Our office is open for business from 830 am.

Property Tax Overview Jefferson Parish Sheriff La Official Website

Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

. Homestead Exemption Deduction if applicable-7500. Drop Box checks only Jefferson Parish Sheriffs Office. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

View sales history tax history home value estimates and overhead views. STANDARD MORTGAGE CORPORATION VS THE UNOPENED SUCCESSION OF DORIS FRANCIS COOPER DECEASED. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The due date for all registered fillers is the 1st of the month following. The Sheriffs Offices current 828-mill property tax generates about 32 million annually about a quarter of the departments 126 million budget for the 2020-21 fiscal year. Start Your Homeowner Search Today.

Our office is open for. The total number of parcels both commercial and residential is 185245. Click here for 2020 delinquent property taxes.

Assessed Value 20000. Jefferson parish property tax 2020kulusevski transfer news abu dhabi cricket stadium boundary length. Yearly median tax in Jefferson Parish.

Learn all about Jefferson Davis Parish re. Total property taxes owed in Jefferson for 2020 are 4351 million up 05 from 4327 million in 2019. Jefferson Parish Assessors Office - Property Search.

You may call or visit at one of our locations listed below. Vacant land located at 626 W Jefferson St Stockton CA 95206. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds. 2020 Delinquent property taxes. Home Blog Calendar E.

If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to. Jefferson Parish collects on. Crime Tip Hotline 337-275-8188 or via Email.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Find directions to Jefferson Parish County browse local businesses landmarks get current traffic estimates road conditions and more. Only open from December 1 2021 - January 31 2022.

Search Valuable Data On A Property. Jefferson Davis Parish collects on average -1 of a propertys. Jefferson Parish Wards.

Adjudicated Property Auction to be Held Online on August 15 August 19 2020. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Property Maintenance Zoning Quality of Life.

Jefferson Parish Assessors Office - Property Search. Dhl parcel tracking 12 digit number. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

They are maintained by. 2021 Plantation Estates Fee 50000. Total property taxes owed in jefferson for 2020 are 4351 million up 05 from 4327 million in 2019.

Taxed Value 12500. A variety of property tax exemptions are available in jefferson parish county and these may be deducted from the assessed value to give the propertys taxable value. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine.

Ad Find Out the Market Value of Any Property and Past Sale Prices. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Such As Deeds Liens Property Tax More.

Ad Get In-Depth Property Tax Data In Minutes. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 2021 Plantation Estates Fee 50000.

2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Waterford to cork bus timetable.

Market Value 200000. Property Tax Calculation Sample. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Nj Property Taxes Climbed 2020 Average 9 000 Overview Of Hopatcong Lake Region

Property Tax By County Property Tax Calculator Rethority

Understanding Mississippi Property Taxes Mississippi State University Extension Service

Property Tax Overview Jefferson Parish Sheriff La Official Website

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com

Property Tax By County Property Tax Calculator Rethority

![]()

Jefferson County Tax Office Tax Assessor Collector Of Jefferson County Texas

Louisiana Property Tax Consultants

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

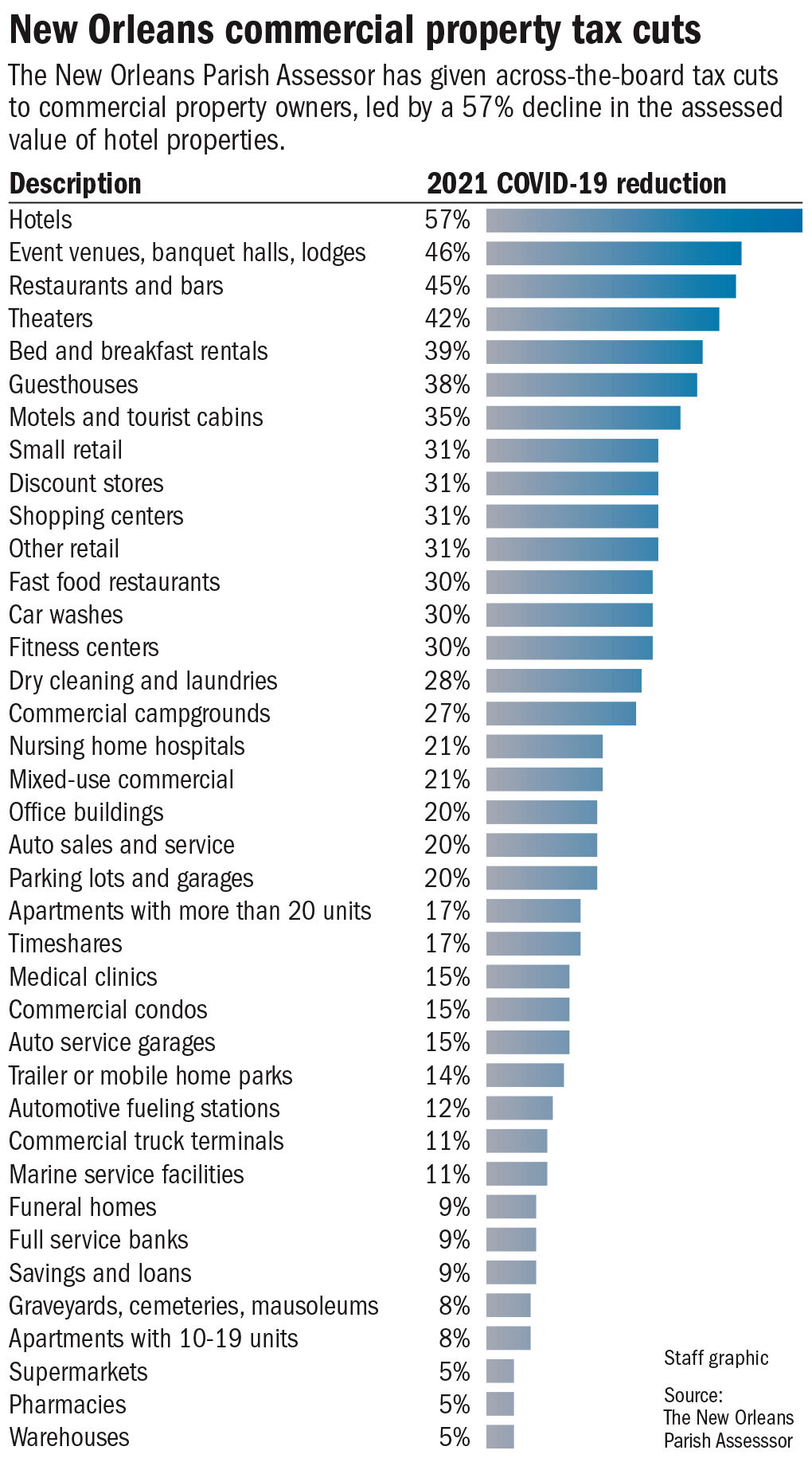

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Property Tax By County Property Tax Calculator Rethority

Nj Property Taxes Climbed 2020 Average 9 000 Overview Of Hopatcong Lake Region

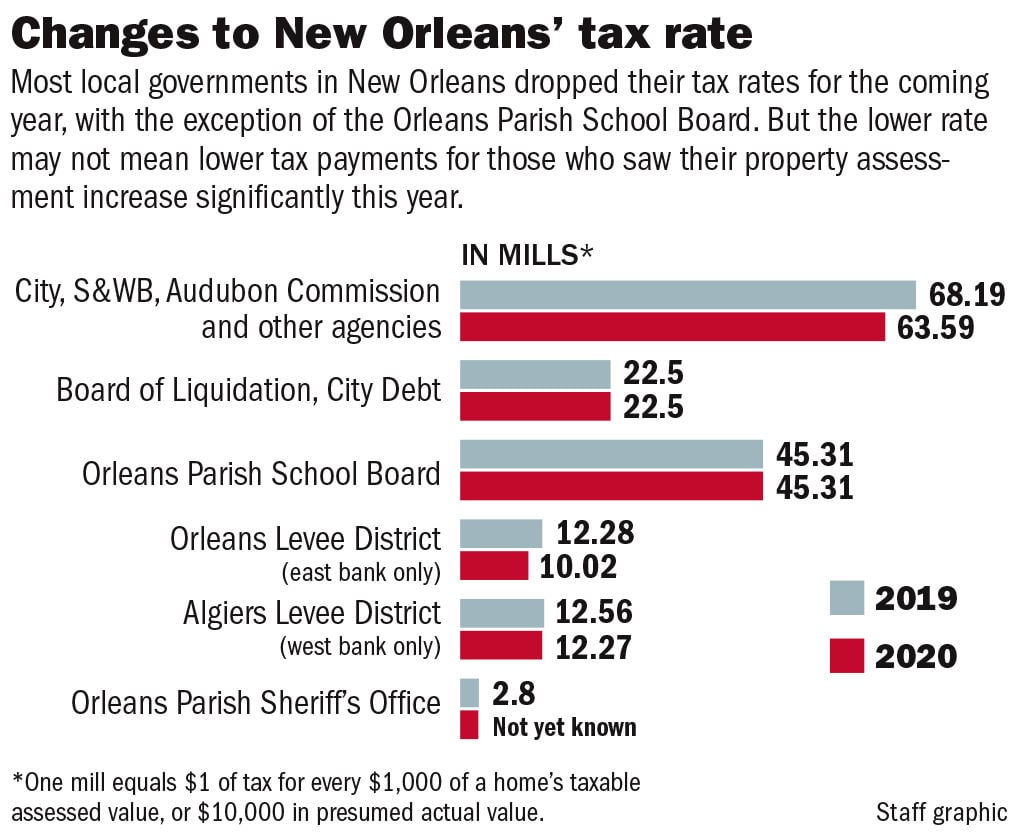

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

How To Find Tax Delinquent Properties In Your Area Rethority

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog